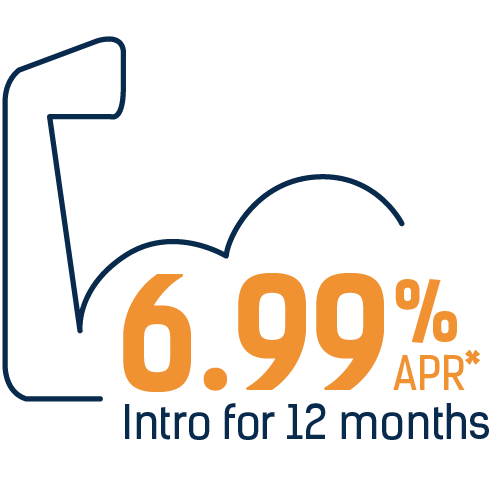

Flex Home Equity Line of Credit

You need money, and your home may be the solution. With a Flex Home Equity Line of Credit, you can make improvements to your home, take a trip, or pay for college or a wedding. And it's a line of credit that is always available. At Heartland, we’re here to help make your dreams come true in any way we can.

It’s the Heartland Way.

APR*

APR*

Flex Home Equity Line of Credit Features

- Borrow up to 90% of the value of your home

- Payment terms up to 180 months on your balance

- Interest-only payments with the flexibility to pay more

- Access funds from your master line of credit at any time

- Convenient advance options - Access funds online, via mobile banking, call us or stop in

Have an HCU staff member contact you about a Flex Home Equity Line of Credit.

*Annual Percentage Rate. Membership required. Subject to credit approval. 6.99% introductory APR will be in effect for the first twelve months after your line of credit is opened. Upon expiration of the introductory rate, all balances will accrue interest at the variable standard APR, which can range from Prime minus .01% to Prime +.99%, using the Wall Street Journal Prime Rate (currently an APR of 7.49%) not to exceed 18% at any time, with a floor rate of 3.25%. Information accurate as of 1/1/2025. This offer is available to new Home Equity Lines of Credit only and is subject to change without notice. No application or origination fees for qualifying members who have an active Spending account with direct deposit. $49 origination fee for non-qualifying accounts. Normal third-party fees for appraisal, title, and taxes apply.